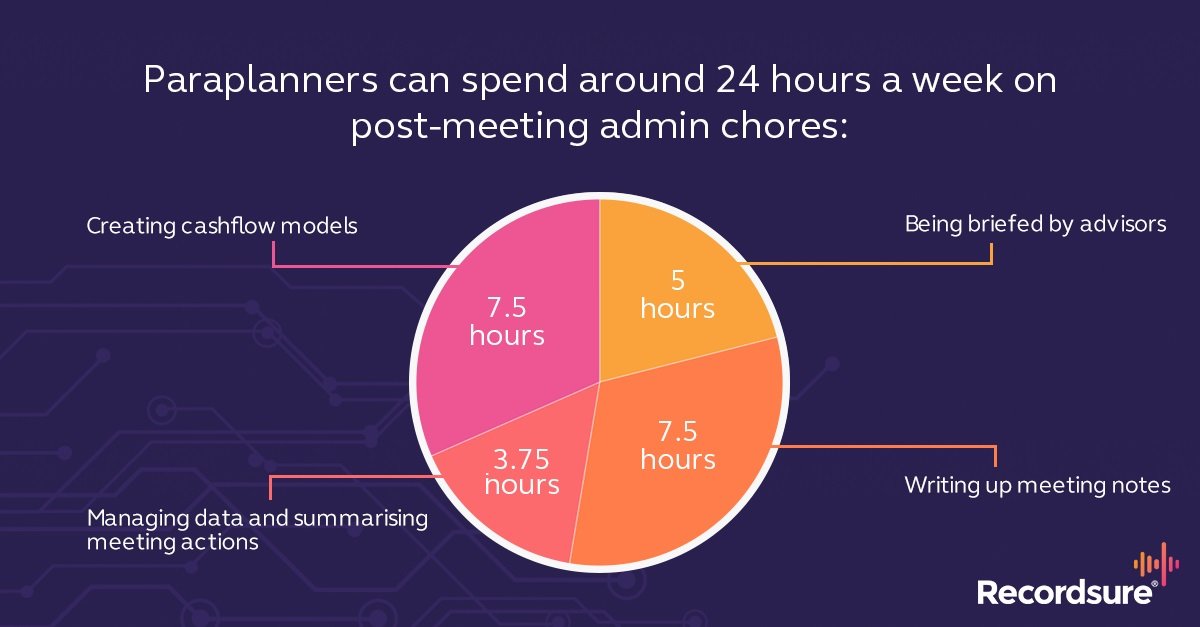

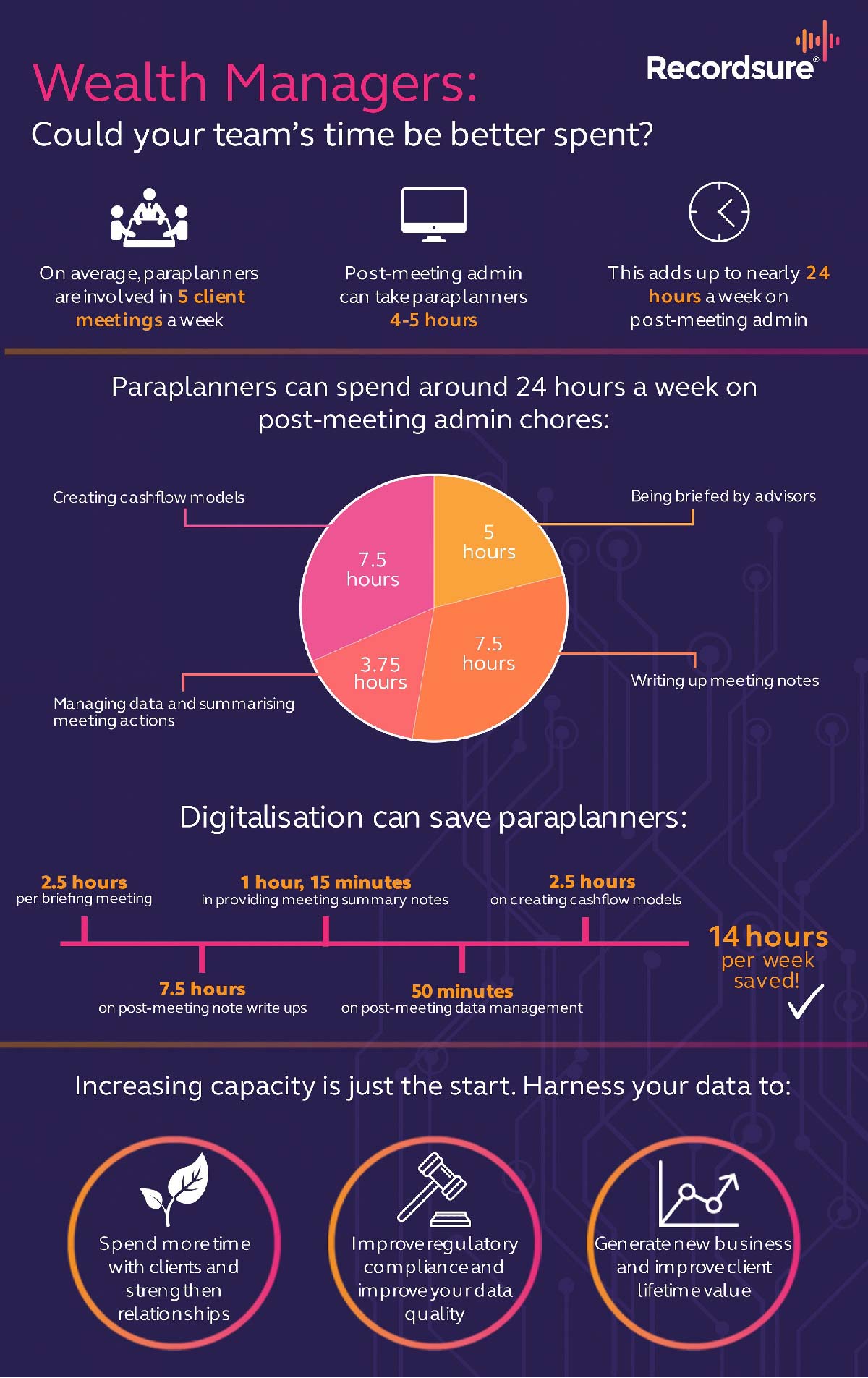

Wealth Managers’ teams are losing considerable amounts of time each week in post-meeting administration. On average, paraplanners conduct 5 client meetings per week, each one requiring around 4 hours and 45 minutes of post-meeting administration. When you total this up across an entire week, this adds up to nearly 24 hours of administration work.

Essentially, paraplanners are losing an entire day to administration chores, time that could be better spent working with clients. Digitalisation gives paraplanners the opportunity to streamline their operations and leverage valuable capacity. Digital tools can be implemented into every aspect of their work, whether it is providing automatic transcriptions of conversations, developing cash flow models more efficiently, or post-meeting data management. The implementation of technology has the potential to save paraplanners 14 hours per week!

These additional hours, allow teams to spend more valuable time with their clients, helping to build trust and strengthen relationships. Harnessing data also means wealth managers can improve client lifetime value by better understanding client needs. Digitalisation of these administration activities also makes regulatory compliance more effective, by improving the quality of data and making it easily accessible.

Interested in learning more about how RegTech and digitalisation can support wealth managers and paraplanners? Get in touch.