According to EY Global Wealth Management Research, 39% of European clients plan to switch advisers in the next three years. These recent figures heighten the pressure for firms to continuously raise the bar when it comes to satisfying customer needs, especially against the intensified competition. The last digital advancements can help wealth managers excel even further in their roles by providing them with unprecedented insight and knowledge into their clients, giving them an upper hand in the market.

Quality

52% of clients value quality and reputation as being a high-value priority when choosing a firm. When operating in such a regulated field, managers must ensure quality control is always to the highest standard and compliance guidelines are continuously being met. As part of this, some customer interactions will be supervised for quality control purposes.

In the case of face-face meetings, a third-party member, which the client may have previously never met joins the meeting to undergo the compliance supervision. This can disrupt the rhythm of the conversation, with clients and managers alike feeling awkward or nervous and in some rare cases erode the trust that has been built. Questions like; why are they being reviewed? or are they proficient in their role? may even enter a client’s mind.

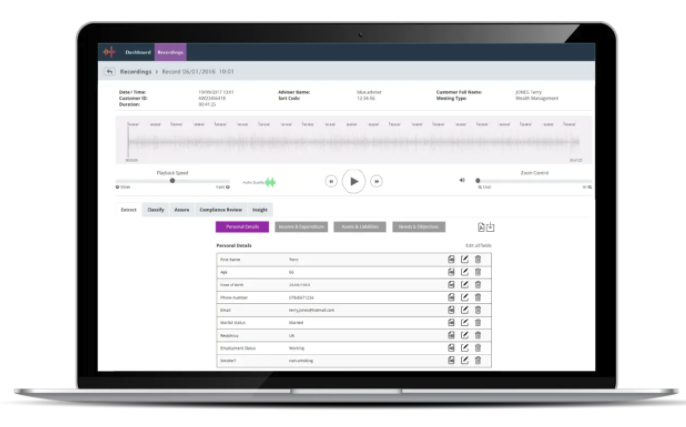

Whereas, if our Capture automated speech transcription tool was used, supervisors would no longer have to be present in the meeting. They would have the ability to review conversations at a separate date and remotely. Helping advisers to maintain natural conversations with their clients, whilst saving supervisors hours each week due to the removal of travel.

Automated transcriptions also mean that metadata is collected together, making files easily accessible and searchable, even at scale. This enables supervisors to review a greater proportion of conversations. Currently, only around 1-5% of client interactions are being monitored, implementing our solution offers 100% coverage of compliance across the business and ensures consistency throughout. With so many tools like these becoming available, it is only a matter of time before application moves from optional to compulsory, with the FCA expecting more from firms.

Insight-led

Aside from the compliance benefits, the implementation of this type of technology could also lead to a more insight-led ecosystem due to the information that is being derived from these conversations. When understanding your customer is a core quality expected of advisers and 53% of clients stating advisory capabilities as a high priority when choosing firms, advisers must demonstrate strong customer knowledge.

Customer knowledge that is currently held in CRM systems is too thin to be meaningful but having in-depth information from every single interaction enriches profiles. With the use of AI-driven tools, the recorded customer conversations can be analysed to develop discoverable, understandable and actionable insights. Our machine learning algorithms are trained to identify nuanced topics and facts from conversations that could identify whole new opportunities.

Say, for example, a client mentions their child’s graduation, and are therefore no longer paying school tuition fees, indicating more disposable income that could be invested. Details like these could be easily missed in the flow of the conversation but insight from the conversations could prompt better product recommendations and uncover new business opportunities.

Macro trend analysis

The more conversations advisers have, the more valuable the insights become. Over time, the technology can recognise trends and patterns in behaviour on an individual basis but also across the entire client base. AI-drive analysis can monitor interactions and detect correlations that occur within group areas. For example, the analysis of the data may indicate that younger clients are more risk-averse, more inclined to go for sustainable investments or may have a preference for more digitalised services. The insight derived from this analysis can help firms to adapt their operations and aid advisers with more informed product recommendations for designated categories.

Efficiency

This data-led approach is also a lot more efficient and can help managers get to the root of the client’s needs at a much quicker rate, freeing up valuable time. According to research, paraplanners can spend an obscene 24 hours a week on post-administration chores, so becoming more digitalised and using the insight extracted from conversations can save a predicted 14 hours, which would be better spent working with clients.

Our Voice solutions pull out core topics such as personal data or expenditure and stores them in a categorised form, removing the arduous task of collecting unstructured data from advisers notes or listening back to recordings on dictaphones. Paraplanners would have one central location where this data is readily accessible, so less time is wasted collating information from various sources or chasing clients for missed details. Providing additional time for advisers to connect with their clients, helping to improve client lifetime value or generate new business.

In such a competitive landscape, financial firms are consistently looking for new and improved ways to better serve their customers. However, one thing still remains the same, a client and adviser relationship is completely dependent on trust. The use of AI-driven analytics can support them to strengthen relationships and gain more value from each client.

To better understand how our advanced speech and document analytics tools can provide your firm with unappareled client insights, get in touch with our team.